Comprehensive Analysis of the 2024 Statistical Review of World Energy: Key Trends, Challenges, and Contradictions

The 2024 Statistical Review of World Energy, issued by the World Energy Institute, provides a comprehensive overview of global energy trends, highlighting significant changes in production, consumption, and trade. This analysis delves into the report’s critical findings, emphasizing progress toward sustainable energy, the continued reliance on fossil fuels, and the inherent contradictions in the global push toward CO2 neutrality.

Global Primary Energy Consumption and Distribution

In 2023, global primary energy consumption rose by 2% to a record 620 exajoules (EJ). This growth rate was 0.6% above the ten-year average and more than 5% higher than the pre-COVID-19 level in 2019. Non-OECD countries dominated both the share and growth of energy consumption, driven by industrialization and economic expansion. The rapid industrial growth in these regions has led to increased demand for energy, particularly in sectors like manufacturing, construction, and transportation. This demand highlights the need for sustainable energy solutions to balance economic growth with environmental protection.

Specifically, non-OECD countries face the challenge of meeting rising energy demands while minimizing environmental impact. Goals in these regions include enhancing access to affordable energy, supporting economic growth, and transitioning to cleaner energy sources. Governments are focusing on implementing renewable energy projects, improving energy efficiency, and creating policies that encourage investment in sustainable technologies to ensure that economic development does not come at the cost of environmental degradation.

Fossil Fuels: Persistent Dominance and CO2 Emissions

Fossil Fuel Share

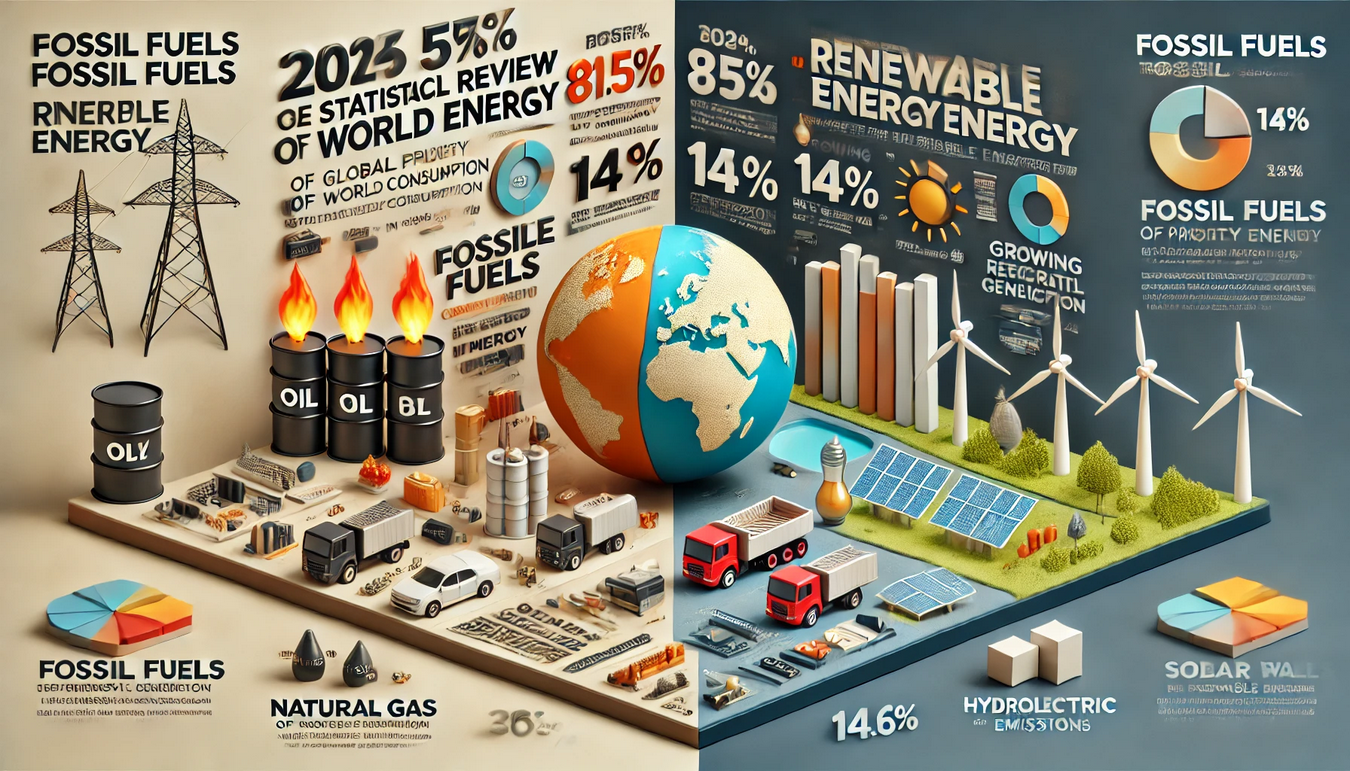

Despite rapid growth in renewable energy, fossil fuels still made up 81.5% of global primary energy consumption in 2023. Oil, natural gas, and coal remained the main energy sources, with coal playing a significant role in electricity generation. The slow decline in the reliance on fossil fuels indicates the challenges of transitioning to cleaner energy sources, especially given ongoing investments in fossil fuel infrastructure.

For instance, while many countries have pledged to reduce their fossil fuel consumption, significant financial resources continue to be allocated toward new oil and gas projects. In 2023, major economies like the United States and China increased their investments in fossil fuel extraction, highlighting a contradiction between their climate commitments and actual energy policies. The expansion of coal plants in India, despite the country’s renewable energy targets, further exemplifies the conflicting national policies that hinder progress toward global CO2 neutrality. The continued use of coal, in particular, poses a significant barrier to reducing global greenhouse gas emissions, as it remains one of the most carbon-intensive energy sources.

CO2 Emissions

Energy-related greenhouse gas emissions exceeded 40 gigatonnes of CO2 equivalent (GtCO2e) in 2023. Fossil fuel combustion contributed about 87% of total emissions. While regions like the European Union saw emission reductions, the Asia-Pacific region, particularly China, experienced increases. The rise in emissions in developing regions is primarily driven by increased industrial activity, urbanization, and rising living standards. These trends underscore the need for effective policies and technologies to mitigate emissions while supporting economic growth.

Oil and Natural Gas Dynamics

Oil Production and Consumption

Oil production reached a record 96 million barrels per day, with the United States leading production growth and China driving demand recovery. Despite an 18% drop in oil prices, the average price of $83 per barrel remained higher than pre-pandemic levels. The resilience of oil production despite price fluctuations highlights the ongoing global dependence on oil as a key energy source. The growth in demand, particularly in China, reflects the broader recovery of global economies following the COVID-19 pandemic, with transportation and industry driving much of the demand.

Natural Gas Production and Prices

Natural gas prices fell significantly, with European and Asian prices dropping by 30% and U.S. prices by 60%, returning to 2019 levels. The U.S. remained the largest producer, supplying about a quarter of the global natural gas. The decrease in natural gas prices was largely due to increased production capacity and a milder winter in key consuming regions. Natural gas continues to play a crucial role in balancing energy supply, especially as a backup for intermittent renewable sources like solar and wind. However, its role in emissions cannot be overlooked, as methane leakage during extraction and transportation remains a significant environmental concern.

Coal Production and Electricity Generation

Coal Production and Consumption

Coal production reached a high of 179 EJ, with the Asia-Pacific region contributing nearly 80% of global output. Global coal consumption grew by 1.6% to 164 EJ, with China and India being the largest consumers. The heavy reliance on coal in these regions is driven by the need for affordable energy to support industrial growth and electricity generation. Despite global efforts to reduce coal use, its abundance and cost-effectiveness make it a preferred energy source in many developing economies, highlighting the need for targeted policies and incentives to reduce coal dependency.

Electricity Generation

Global electricity generation grew by 2.5%, reaching a record 29,925 terawatt-hours (TWh). Fossil fuels accounted for 60% of electricity generation, while the share of renewables rose to 30%, driven by increases in solar and wind capacity. The growth in electricity demand is linked to increased electrification of industries, transportation, and residential sectors. The expansion of renewable energy capacity is encouraging, but the slow pace of transition from fossil fuels to renewables highlights the challenges of meeting rising energy demand sustainably. Grid integration, storage solutions, and policy support are crucial to accelerating this transition.

Renewable Energy and Energy Efficiency

Renewable Energy Growth

Renewables’ share of global primary energy consumption increased to 14.6% in 2023. Solar and wind energy saw substantial growth, with installed capacities reaching 346 GW and 186 GW, respectively. The growth in renewable energy capacity has been driven by falling technology costs, government incentives, and increased public awareness of climate change. However, challenges such as intermittency, grid infrastructure, and storage solutions remain significant barriers to achieving a higher share of renewables in the energy mix.

Energy Efficiency

Efforts to improve energy efficiency have yielded positive results in many regions. For instance, the European Union’s initiatives reduced per capita energy consumption and CO2 emissions. Energy efficiency measures, including building retrofits, improved industrial processes, and efficient transportation systems, have contributed to these gains. However, the pace of efficiency improvements needs to accelerate to keep up with the rising energy demand.

Investment in energy-efficient technologies and policies that incentivize energy-saving practices are crucial for achieving long-term sustainability goals. A comparison of current investments reveals a stark inconsistency: global investments in energy efficiency remain significantly lower than fossil fuel subsidies, which continue to receive substantial financial support. This disparity hinders the progress of energy efficiency initiatives and underscores the need for the reallocation of financial resources to better support sustainable energy goals.

Key Minerals and Materials

Production and Prices

Production of key minerals, such as lithium and cobalt, grew by around 4% annually. However, prices for these critical materials fell by about 26% in 2023, with notable declines in cobalt (-47%), pet needle coke (-36%), and lithium carbonate (-32%). Africa, particularly the Democratic Republic of Congo, dominated global cobalt production. The availability and affordability of these minerals are vital for the energy transition, as they are essential components of batteries and other renewable energy technologies. The volatility in prices reflects supply chain challenges, geopolitical tensions, and fluctuating demand. Ensuring a stable supply of these materials will be critical for scaling up renewable energy technologies and electric vehicles.

Energy Security and Trade

North America

Due to the shale oil and gas boom, North America transitioned from a net importer to a net exporter of energy. This shift has significant implications for global energy markets and geopolitics, as the region’s energy independence reduces its reliance on foreign energy supplies and enhances its influence in global energy trade.

Europe

Europe remained a net importer, heavily reliant on external sources of oil and natural gas. The region’s dependence on imported energy makes it vulnerable to supply disruptions and price volatility. The ongoing efforts to diversify energy sources and increase renewable energy capacity are part of Europe’s strategy to enhance energy security and reduce dependency on external suppliers.

Asia-Pacific

The Asia-Pacific region consumed 47% of the world’s total energy in 2023, making it the largest energy consumer, heavily dependent on imported oil and natural gas. The region’s energy needs are driven by rapid economic growth, urbanization, and industrialization. Ensuring energy security in this context involves diversifying supply sources, investing in renewable energy, and improving energy efficiency to manage growing demand sustainably.

Specific investments in the region include large-scale solar and wind projects, such as China’s commitment to expanding its renewable energy capacity to 1,200 GW by 2030 and India’s focus on achieving 500 GW of non-fossil fuel capacity by the same year. Additionally, Japan is investing in hydrogen technology as part of its strategy to enhance energy security while reducing emissions. However, these investments often conflict with ongoing reliance on coal and natural gas, reflecting the tension between energy security goals and sustainability commitments. For example, Indonesia continues to expand its coal power capacity to meet rising electricity demand, despite also investing in renewables. These conflicting policies highlight the challenges the region faces in balancing economic growth, energy security, and environmental sustainability.

Contradictions in the Global Push Toward CO2 Neutrality

Despite significant progress in renewable energy adoption and energy efficiency, several contradictions hinder the movement toward CO2 neutrality:

Fossil Fuels vs. Renewable Energy Growth

Fossil fuels still dominate the global energy mix, accounting for 81.5% of primary energy consumption. Renewables, although growing, only reached 14.6%, highlighting the slow pace of the transition. The reliance on fossil fuels is particularly pronounced in developing regions, where affordability and availability are key factors.

Accelerating the transition will require significant investments in renewable energy infrastructure, technology development, and policy frameworks that support clean energy adoption. However, securing adequate investments in renewable energy remains challenging compared to the ongoing financial support for fossil fuel projects. In 2023, global fossil fuel subsidies reached an estimated $7 trillion, far exceeding the investments directed toward renewable energy. This disparity highlights the contradiction between stated climate goals and actual financial commitments, making it difficult to shift the energy landscape meaningfully. Greater alignment of investment priorities with sustainability targets is needed to facilitate a faster and more effective energy transition.

Emissions Reduction vs. Economic Growth

Global CO2 emissions from energy consumption rose by 2.1% in 2023, largely due to the increased use of carbon-intensive fuels in developing regions, where economic growth often takes precedence over environmental concerns. Balancing economic growth with emissions reduction is a major challenge, especially in countries where poverty alleviation and improving living standards are high priorities. Innovative solutions, such as carbon capture and storage (CCS) and green financing, are needed to support sustainable development while reducing emissions.

Energy Consumption vs. Efficiency Improvements

Global primary energy consumption grew by 2% annually, outpacing efficiency improvements. Although efficiency measures have been implemented, they remain insufficient to counter the rising energy demand driven by industrialization and population growth. The gap between energy demand and efficiency gains highlights the need for more aggressive policies and investments in energy-efficient technologies. Public awareness campaigns, financial incentives, and stricter efficiency standards can help bridge this gap.

Investments in Renewables vs. Fossil Fuels

While investments in renewable energy have increased, substantial financial resources are still directed toward fossil fuel extraction and infrastructure. For example, global oil production increased by 2.1 million barrels per day in 2023, reflecting continued investment in fossil fuels. This inconsistency in investment priorities reflects the complexities of transitioning to a low-carbon economy, where existing infrastructure, economic interests, and energy security concerns continue to favor fossil fuels. Redirecting investments toward renewables and supporting technologies like energy storage and grid modernization is essential for achieving a sustainable energy future.

Conclusion

The 2024 Statistical Review of World Energy underscores the complexities and contradictions in the global energy landscape. While there has been commendable progress in renewable energy adoption and energy efficiency, the persistent dominance of fossil fuels and rising CO2 emissions pose significant challenges. Achieving CO2 neutrality and effectively combating climate change will require accelerated efforts to transition to sustainable energy, improve efficiency, and reduce reliance on fossil fuels.

Regional disparities in energy consumption and emissions further highlight the need for tailored strategies to address these challenges globally. Collaborative international efforts, innovative technologies, and supportive policy frameworks will be crucial in overcoming the obstacles to a sustainable energy future. Key academic and policy recommendations to support a faster transition include increased international collaboration on technology sharing, establishing global standards for renewable energy integration, and enhancing financial mechanisms such as green bonds and climate funds to direct investments towards renewable energy projects. The urgency of the climate crisis demands a cohesive global response that not only addresses the energy needs of today but also paves the way for a cleaner, more sustainable tomorrow.